On October 1, the Ministry of Investment and Downstream Industry/BKPM issued Regulation No. 5 of 2025 on Risk-Based Business Licensing and Investment Facilities through the Online Single Submission (OSS) System (“BKPM Reg 5/2025”). This regulation serves as the implementing regulation of Government Regulation No. 28 of 2025 on the Organization of Risk-Based Business Licensing (see our previous newsflash for a summary of this government regulation).

BKPM Reg 5/2025 provides detailed procedures for the application, evaluation, and supervision of business licenses, including adjustments to the OSS system, updated reporting obligations, and expanded licensing coverage. The changes also introduce the fiktif positif (fictitious positive) mechanism, clearer environmental approval procedures, and adjustment in capital and investment requirements.

Below are some of the key highlights and implications of BKPM Reg 5/2025:

Changes to PMA’s Paid-up Capital Requirements and Minimum Investment Value

BKPM has reduced the minimum paid-up capital (capital at establishment) requirement for foreign investment companies (“PT PMA”) to IDR2.5 billion, a significant decrease from the previous IDR10 billion minimum to promote easier market entry and attract more foreign investors.

In parallel, the regulation introduces a 12-month holding period for paid-up capital funds. During this period, the deposited funds must be maintained and may not be withdrawn or transferred, except when used for asset acquisition, building construction, or business operations.

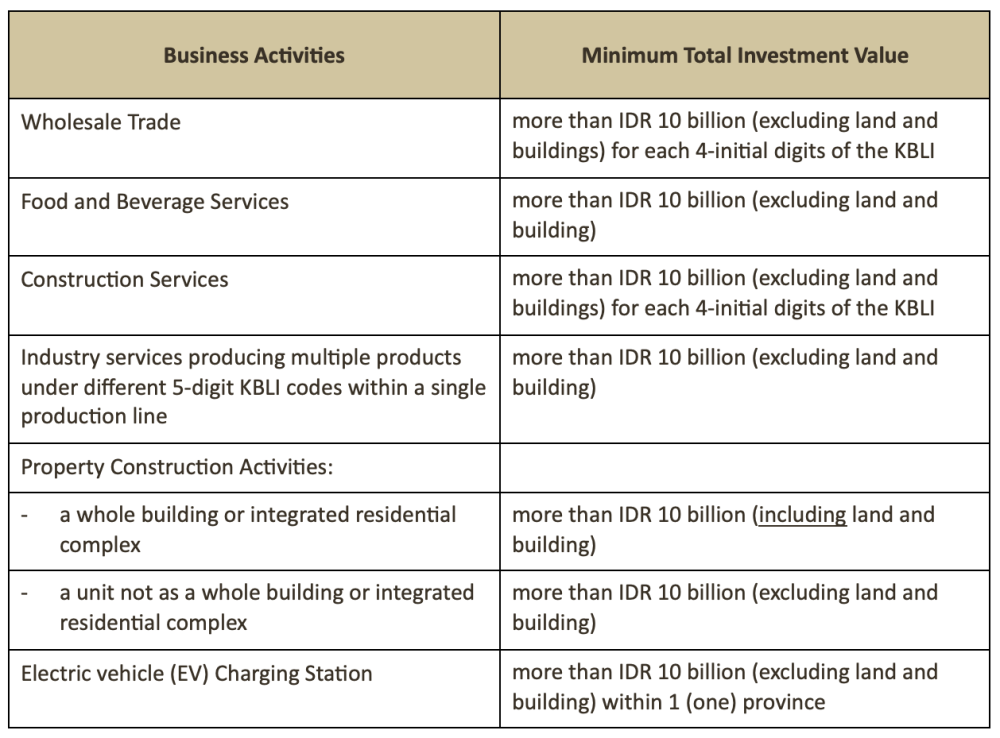

The regulation, however, maintains the general requirement of a minimum total investment value of more than IDR10 billion (excluding land and buildings) for each 5-digit Indonesian Standard Industrial Classification (Klasifikasi Baku Lapangan Usaha Indonesia or “KBLI”) code per project location, except for certain business activities as below:

BKPM Reg 5/2025 also clarifies that the minimum total investment value includes land and building for PT PMA engaging in the following business activities:

- property development, including construction, sale, and/or lease;

- short-term and long-term accommodation services;

- agriculture;

- plantation;

- livestock; and

- aquaculture.

Licensing Timeframes and Introduction of Fiktif Positif (Fictitious Positive) Mechanism

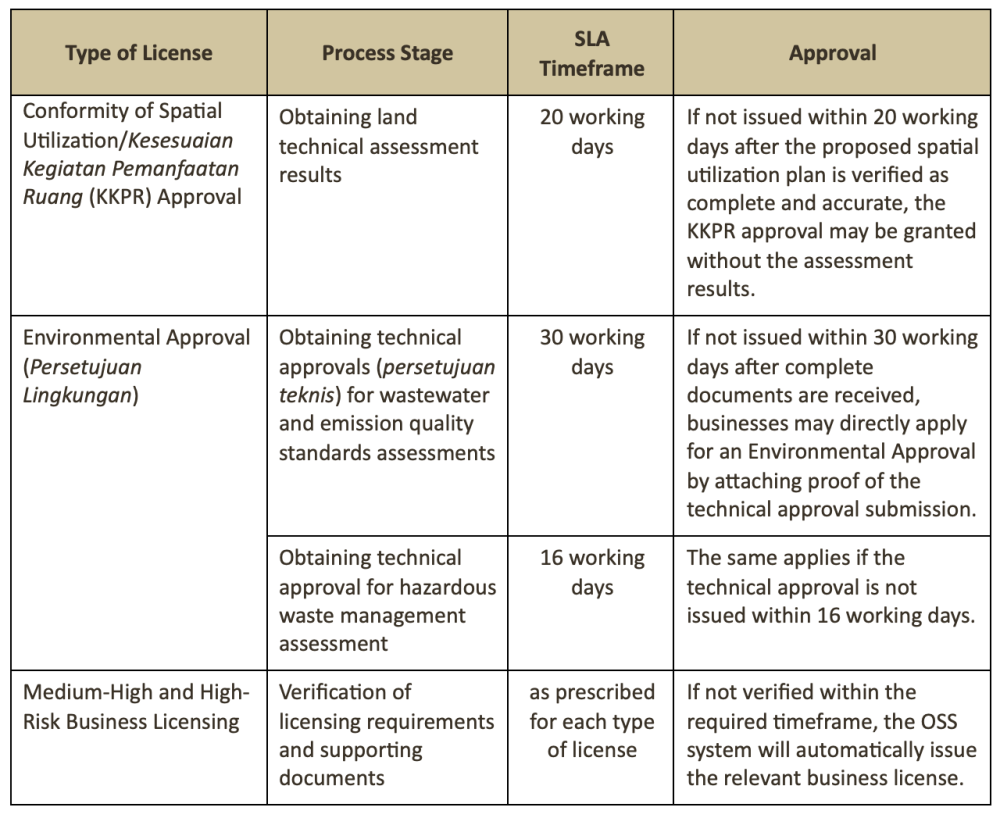

BKPM Reg 5/2025 introduces the fictitious positive or deemed approval mechanism. This means that each licensing process is subject to a specific Service Level Agreement (SLA) that sets the maximum processing time to be followed by the relevant authority.

If the authority fails to issue a decision within the prescribed period, the application will be deemed approved, and the next stage of licensing process may proceed. This mechanism aims to provide clearer timeframes and greater predictability for businesses in securing the necessary licenses.

Below are examples of the applicable SLA timeframe and how the approval mechanism applies:

To date, BKPM only lists 258 KBLI codes to which the fictitious positive approval mechanism applies. These 258 KBLI codes span various industries, primarily those related to tourism, agriculture, manufacturing, and e-commerce.

Note that post-licensing audit or supervision still applies, so BKPM retains the authority to review and verify licenses issued under the fictitious positive approval mechanism if any inconsistencies or irregularities are found.

Accelerated Licensing Procedures in Designated Economic Zones

To further promote investment realization and improve ease of doing business, BKPM establishes an accelerated licensing mechanism for certain designated strategic economic zones. These zones include:

- Special Economic Zones (Kawasan Ekonomi Khusus or KEK);

- Free Trade and Port Zones (Kawasan Perdagangan Bebas dan Pelabuhan Bebas or KPBPB);

- Industrial Zones (Kawasan Industri); and

- National Strategic Projects (Proyek Strategis Nasional).

Within these areas, business licensing processes are ranted special procedural treatment. In general, certain administrative verifications that are typically conducted prior to license issuance may now be deferred to the post-licensing stage, subject to subsequent audit or supervision by the relevant authorities. This authorizes the relevant authorities to issue the licenses directly through the OSS system, without awaiting completion of the standard pre-issuance verification process.

Streamlined Environmental Approval Process

Under the new licensing regime, environmental approval applications are now submitted and processes through the OSS system, replacing the previous requirement to file applications separately with the relevant authorities.

The OSS system also features an integrated self-screening assessment tool that helps identify the applicable environmental documents or approvals required for each corresponding line of business. This automation aims to reduce administrative ambiguity and ensure greater consistency across licensing processes.

In addition, the regulation emphasizes that businesses operating under multiple KBLI codes within a single integrated operational area must comply with the strictest applicable environmental documentation standard when applying for environmental approval.

Flexibility for Supporting Activities

The regulation introduces greater flexibility for supporting activities (kegiatan usaha pendukung), referring to additional business activities under a different KBLI that complement or facilitate a company’s main business activity. These activities are exempted from the minimum investment value and capital validation requirements, and companies are no longer required to include the KBLI of supporting activities in their articles of association for approval purposes.

Unlike the previous framework, supporting activities may now be permitted to generate their own revenue. This provides more room particularly for PT PMA to carry out ancillary functions to support their main business operations, provided such activities contribute only a limited portion of total revenue.

Under BKPM Reg 5/2025, supporting activities must meet the following conditions:

- must be directly related to and considered supportive of the company’s main business activity

- may serve as a source of income or generate profit for the businesses;

- application for a supporting activity can only be submitted after main business application;

- must use a different KBLI code from the main business activity;

- may begin operations before its main business activity obtains operational/commercial approval;

- must comply with all applicable risk-based licensing requirements.

Compliance Profiling Based on LKPM Reporting

BKPM strengthens its supervision framework by establishing a compliance profiling system based on data from the Investment Activity Report (Laporan Kegiatan Penanaman Modal or “LKPM”). Through the OSS system, LKPM submissions are verified and evaluated against established compliance parameters, allowing BKPM to monitor business performance and identify potential non-compliance.

Based on this evaluation, each business is assigned a compliance score and categorized as:

- Very Good (81–100),

- Good (60–80),

- Less (40–59), or

- Poor (0–39).

The compliance profile serves as one of the bases for determining appropriate follow-up actions, which may include:

- guidance/mentoring, intended to improve compliance with the applicable requirements and business licensing obligations;

- administrative sanctions, applied in cases of continued or material non-compliance; and/or

- field inspections, carried to verify and ensure conformity with licensing requirements.

Transitional Provision

As of the effective date of BKPM Reg 5/2025 on 1 October, the following transitional rules apply:

- Status of existing licenses: Companies that already hold valid and verified business or supporting licenses can continue to operate under their current licenses and are not required to adjust to the new licensing provisions.

- Change of Location or License Extension: For PT PMA that change their business location or extend a risk-based business license issued before 1 October, the applicable capital and minimum investment requirements will follow the provisions under the previously issued and still valid license.

- Business Expansion: For PT PMA that expand their existing business activities under the same approved business license, the applicable capital requirements will remain based on the provision of the license that was issued and verified before the new regulation took effect.

Implications for Businesses

The enactment of BKPM Reg 5/2025 marks the end of the four-month transition period under Government Regulation No. 28 of 2025 and the beginning of the full implementation phase of Indonesia’s risk-based business licensing reform. This new regulation consolidates and replaces the previous implementing regulations on the same matters (BKPM Regulations No. 3, 4, 5 of 2021) into a single unified regulation.

New investors and existing PT PMA should pay close attention to the revised minimum paid-up capital requirements, new holding period obligations for paid-up capital, and the treatment of supporting activities. These changes affect how investment structures are assessed and approved under the new licensing regime.

Companies are also advised to review their OSS accounts and ensure compliance across all active business lines, including the mandatory submission of the LKPM. Proper and timely reporting through the OSS system will be increasingly important as BKPM strengthens its compliance monitoring and supervision framework.